2024-07-19

潤滑油信息網

2024-07-19

潤滑油信息網

韓國 SK Innovation 與 SK E&S 正式宣布合并,成立亞太地區最大的私營能源公司,資產總額達 100 萬億韓元(725 億美元)。這一戰略舉措旨在增強投資組合競爭力、加強財務和利潤結構,并確保快速發展的能源領域的增長勢頭。

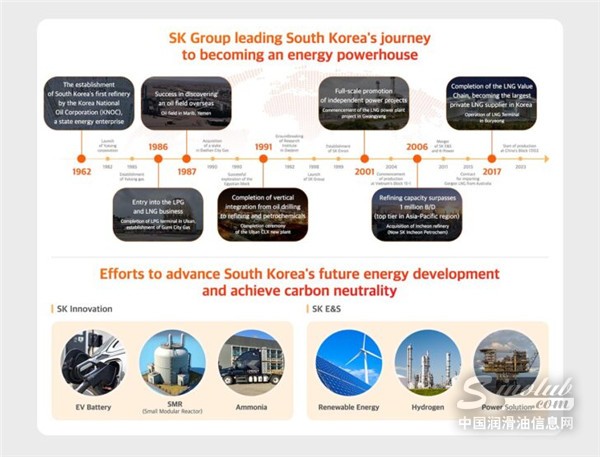

SK Innovation 成立于 1962 年,是韓國第一家煉油公司,此后業務范圍不斷擴大,涵蓋石化產品、潤滑油和石油勘探。該公司目前正在進軍未來能源領域,包括電動汽車電池、小型模塊化反應堆 (molSMRPH)、氨和浸沒式冷卻。這種戰略多元化使 SK Innovation 成為韓國最大的能源公司。

SK E&S 成立于 1999 年,是 SK Innovation 的子公司,最初是一家城市燃氣控股公司。如今,它是韓國領先的私營液化天然氣公司,在全球范圍內完成了液化天然氣價值鏈。SK E&S 正在向綠色投資組合發展,整合其核心業務——城市燃氣、低碳液化天然氣價值鏈、可再生能源以及氫能和能源解決方案——以產生協同效應并促進可持續增長。

SK Innovation 和 SK E?S 于 7 月 17 日分別召開董事會會議并批準了合并提案。如果合并計劃在下個月舉行的各自股東大會上獲得批準,合并后的公司將于 2024 年 11 月 1 日正式成立。

SK Innovation 首席執行官樸尚圭表示:“兩家公司的合并代表著結構性和根本性的創新,旨在通過積極應對能源行業不斷變化的環境來實現可持續增長。通過此次合并,SK Innovation 將成長為一家全方位能源解決方案公司,引領韓國能源行業從現在走向未來。”

SK E&S 首席執行官 Choo Hyeong-wook 補充道:“此次合并不僅將加強兩家公司現有的業務能力,還將確保未來關鍵能源業務的增長引擎。基于合并產生的協同效應,SK E&S 將以四大核心業務為中心,增強綠色投資組合,引領未來能源市場。”

合并的主要亮點

– 全面的產品組合:合并后的實體將涵蓋石油和液化天然氣等現有能源和可再生能源、氫能和小型模塊化反應堆(SMR)等未來能源的整個價值鏈,以及電池和儲能系統(ESS)等電氣化業務。

– 財務實力:合并后的公司計劃到 2030 年實現 EBITDA 20 萬億韓元(145 億美元),這得益于投資組合管理、財務結構和增長計劃的協同效應。此次合并有望通過液化天然氣、電力和城市燃氣業務的穩定盈利能力來緩解石化業務的高利潤波動性。

– 增長動力:通過整合資源和能力,合并后的公司將增強其在能源和電氣化領域的競爭力和盈利能力。這包括將 SK Innovation 的原油煉制和貿易業務與 SK E&S 的天然氣開發和液化天然氣貿易相結合。

戰略目標

– 投資組合競爭力:建立涵蓋所有業務部門的競爭性投資組合。

– 財務穩定:確保穩定的盈利能力以及資產和銷售額的外部增長。

– 增長計劃:通過資源和能力整合,增強競爭力并培育新業務。

South Korea’s SK Innovation and SK E&S have officially announced their

merger, creating the largest private energy company in the Asia-Pacific region

with assets totaling KRW100 trillion (USD72.5 billion). This strategic move aims

to enhance portfolio competitiveness, strengthen financial and profit

structures, and secure growth momentum in the rapidly evolving energy

sector.

Founded in 1962 as South Korea’s first oil refining company, SK Innovation has since broadened its business scope to encompass petrochemicals, lubricants, and oil exploration. The company is now venturing into future energy sectors, including electric vehicle batteries, small modular reactors (molSMRPH), ammonia, and immersion cooling. This strategic diversification has positioned SK Innovation as the largest energy company in South Korea.

Established as a spin-off from SK Innovation in 1999, SK E&S began as a city gas holding company. Today, it is South Korea’s leading private LNG company, having completed the LNG value chain on a global scale. SK E&S is evolving towards a green portfolio, integrating its core businesses—city gas, low-carbon LNG value chain, renewable energy, and hydrogen and energy solutions—to generate synergies and promote sustainable growth.

SK Innovation and SK E?S separately held board meetings on July 17 and approved the merger proposal. If the merger plan is approved at their respective shareholders meeting scheduled next month, the merged corporation will officially launch on November 1, 2024.

Park Sang-kyu, CEO of SK Innovation, stated, “The merger of the two companies represents a structural and fundamental innovation aimed at achieving sustainable growth by proactively responding to the changing environment surrounding the energy industry. Through this merger, SK Innovation will grow into a Total Energy Solution Company that leads Korea’s energy industry from the present into the future.”

Choo Hyeong-wook, CEO of SK E&S, added, “This merger will not only strengthen the existing business capabilities of both companies but also secure growth engines for key future energy businesses. Based on the synergies created through the merger, SK E&S will enhance its green portfolio centered on its four core businesses and lead the future energy market.”

Key highlights of the merger

– Comprehensive Portfolio: The merged entity will encompass the entire value chain of both current energy sources such as oil and LNG, and future energy sources including renewable energy, hydrogen, and small modular reactors (SMR), as well as electrification businesses like batteries and energy storage systems (ESS).

– Financial Strength: The combined company aims to achieve an EBITDA of KRW20 trillion (USD14.5 billion) by 2030, driven by synergies in portfolio management, financial structure, and growth initiatives. The merger is expected to mitigate the high profit volatility of the petrochemical business with the stable profit generation capabilities of the LNG, power, and city gas businesses.

– Growth Momentum: By integrating resources and capabilities, the merged company will enhance its competitiveness and profitability in both energy and electrification sectors. This includes combining SK Innovation’s crude oil refining and trading operations with SK E&S’s gas development and LNG trading.

Strategic Goals

– Portfolio Competitiveness: Establish a competitive portfolio across all business sectors.

– Financial Stability: Secure stable profit generation capabilities and external growth in assets and sales.

– Growth Initiatives: Enhance competitiveness and foster new businesses through resource and capability integration.